CPF for Housing Singapore: Complete 2025 Allocation Guide

When buying property in Singapore, understanding your CPF allocation is crucial.

This complete 2025 guide covers CPF for housing including allocation rates by age

(62.17% at age 30 declining to 14.9% at age 60), usage limits, down payment

strategies, and what happens when you sell property. Learn how to maximize your

CPF Ordinary Account for HDB and private property purchases.

📋 In This Complete Guide:

- How Much CPF Can I Use for Housing in Singapore?

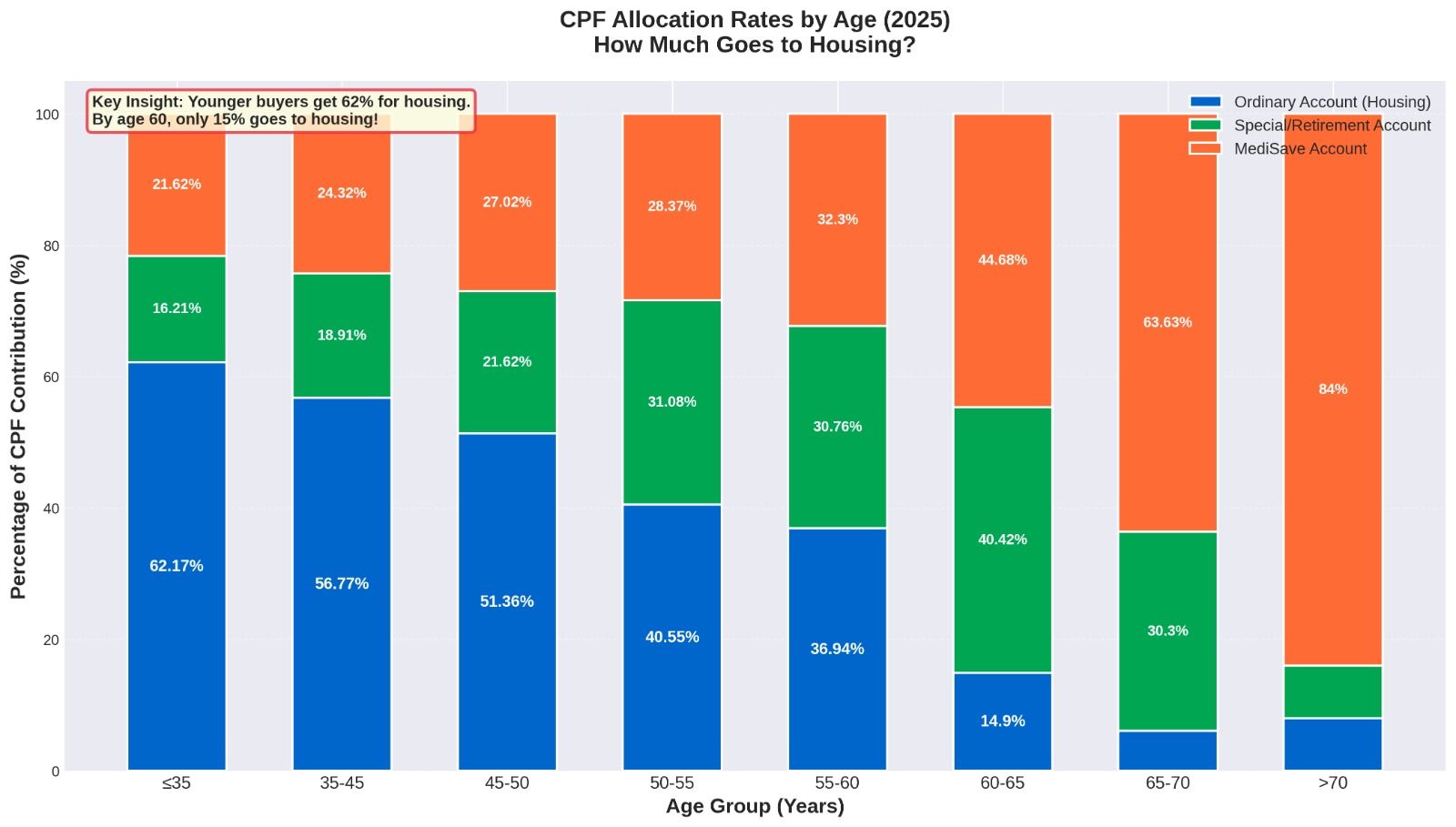

- CPF Allocation Rates by Age (2025)

- What You Can Use CPF OA Savings For

- CPF Usage Limits Based on Property Type

- Why CPF Allocation Matters When Buying Property

- Smart CPF Strategies for Singapore Property Buyers

- Common CPF Housing Questions Answered

How Much CPF Can I Use for Housing in Singapore?

When buying property in Singapore, your CPF Ordinary Account (OA) serves as your primary housing fund. The amount allocated to your OA depends on your age, with younger buyers receiving a larger portion for housing purchases.

CPF Allocation Rates for Housing (2025)

Your monthly CPF contributions are automatically distributed across three accounts, with the Ordinary Account specifically designated for housing:

Age-Based CPF Ordinary Account Allocation:

35 years and below: 62.17% of total CPF goes to housing

Above 35 to 45 years: 56.77% allocated for housing

Above 45 to 50 years: 51.36% for property purchases

Above 50 to 55 years: 40.55% towards housing

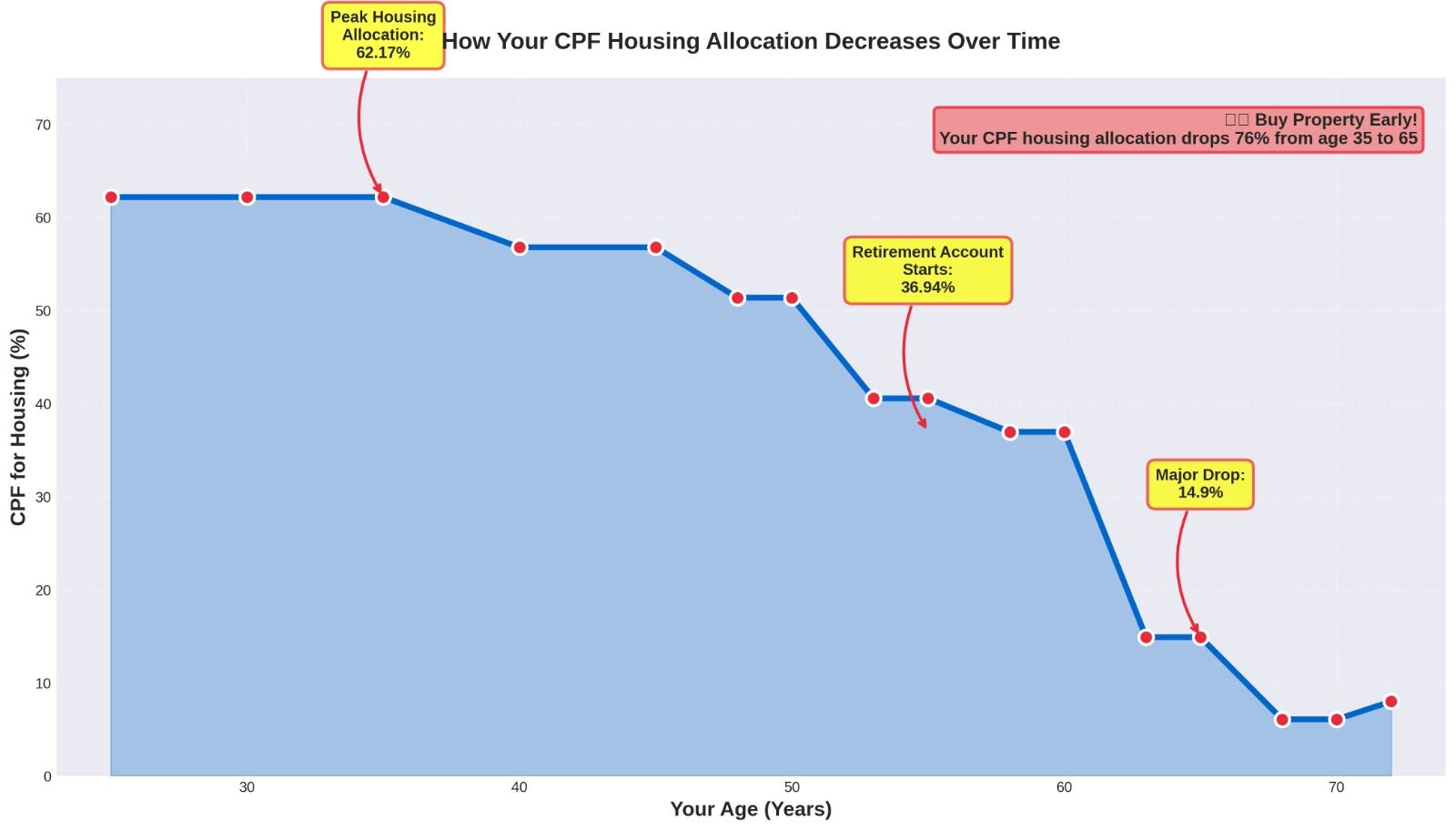

Above 55 to 60 years: 36.94% for property

Above 60 to 65 years: 14.9% to Ordinary Account

Above 65 to 70 years: 6.07% for housing

Above 70 years: 8% allocated to OA

What Does This Mean for Your Property Purchase?

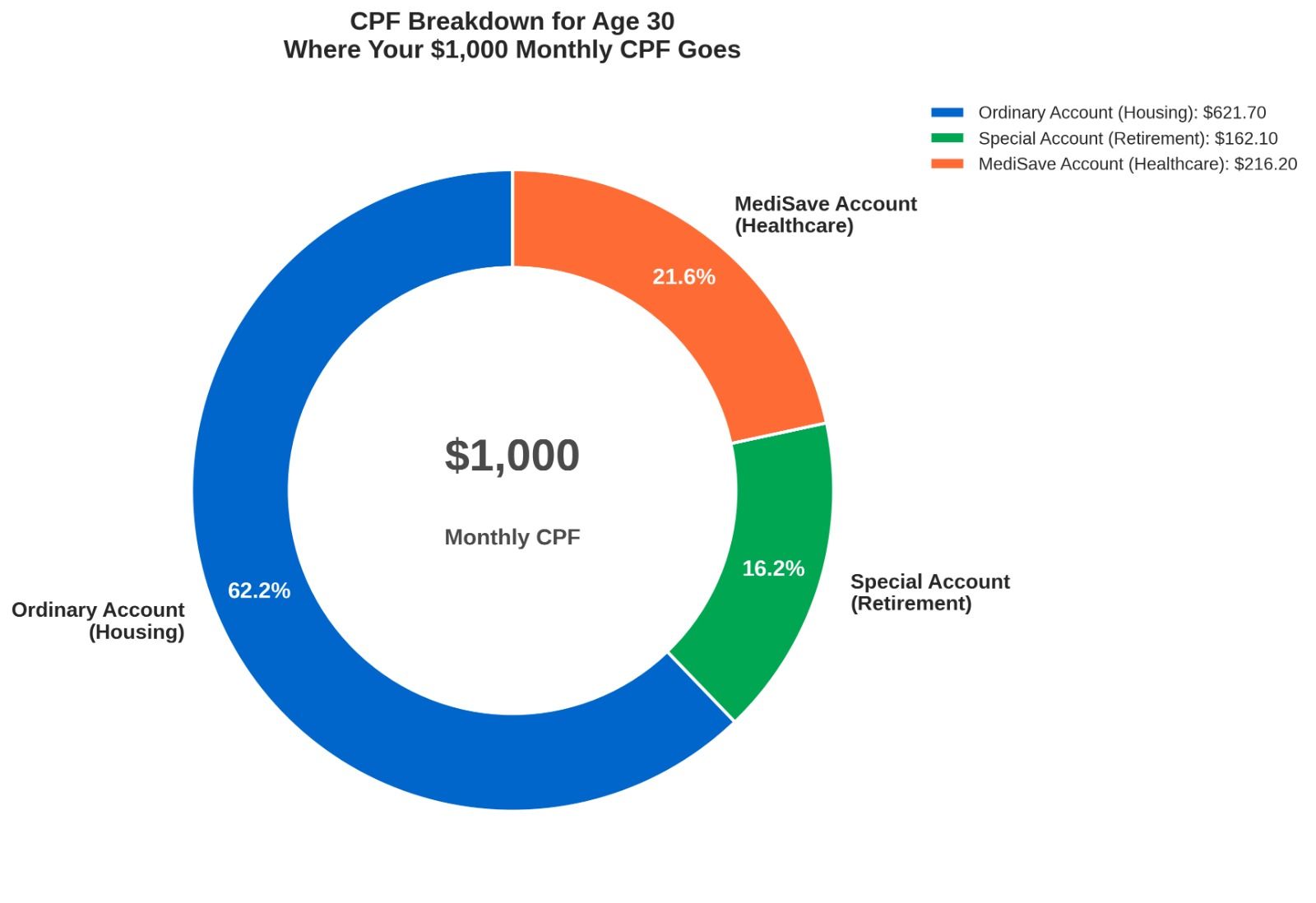

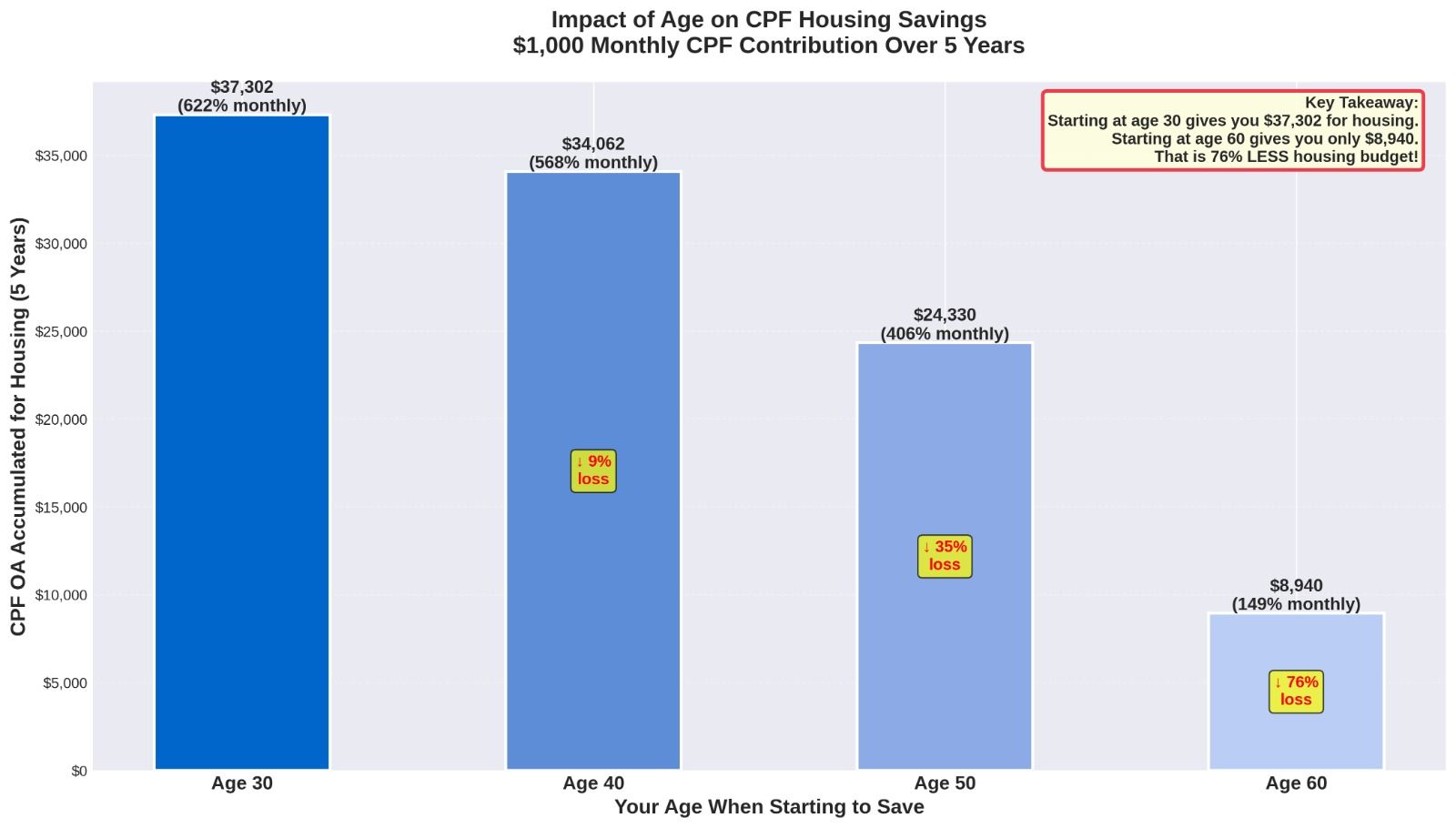

Example: If you're 30 years old with $1,000 monthly CPF contribution:

$621.70 goes to your Ordinary Account (available for housing)

$162.10 goes to Special Account (retirement)

$216.20 goes to MediSave (healthcare)

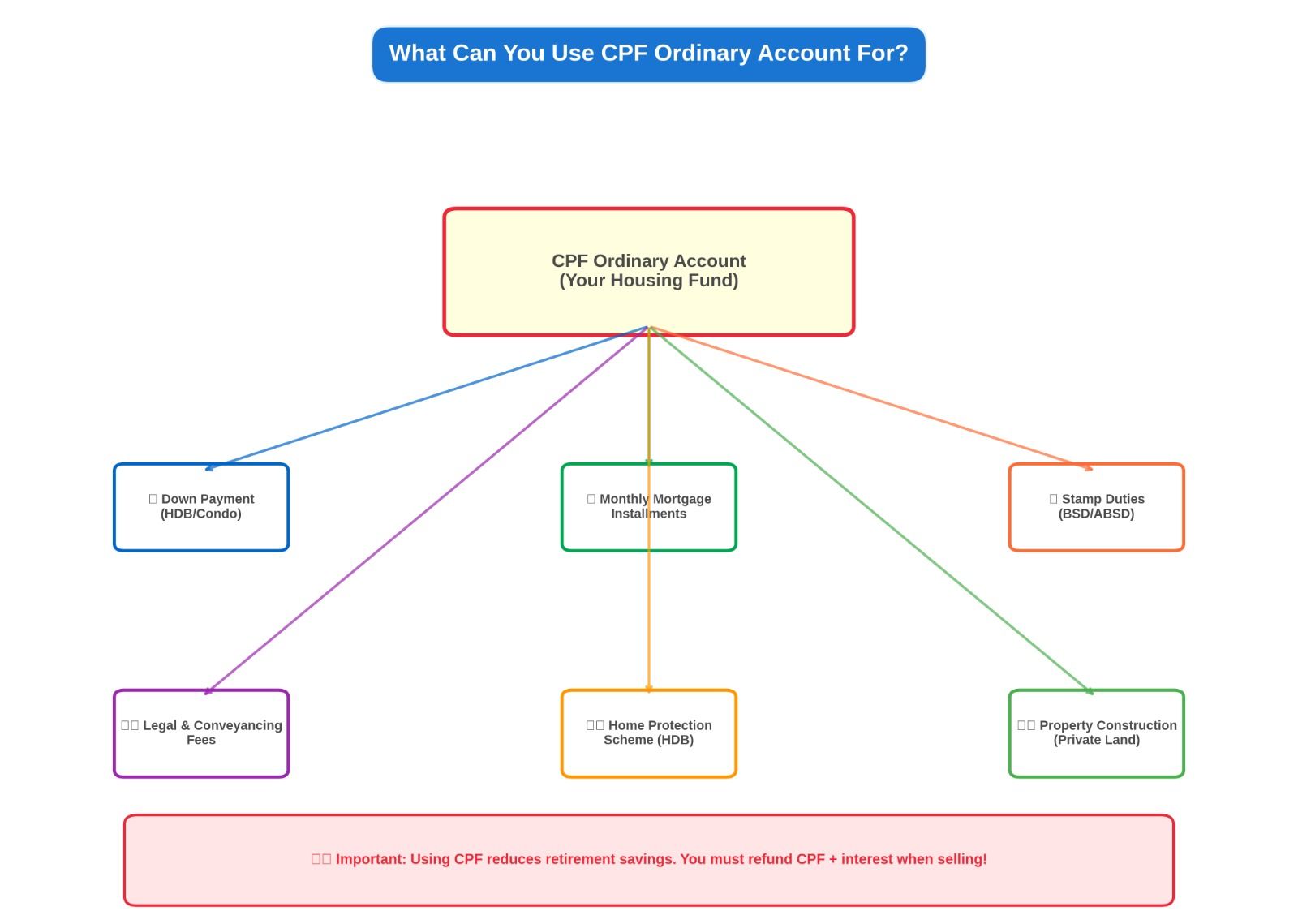

What Can You Use CPF OA Savings For When Buying Property?

Your CPF Ordinary Account can cover multiple aspects of property purchase in Singapore:

1. Down Payment

Use OA savings to pay the initial deposit for your HDB flat or private condominium. For bank loans, at least 5% must be cash, but the remaining down payment can come from CPF.

2. Monthly Mortgage Installments

Automate your housing loan repayments directly from your OA balance, reducing your monthly cash outlay significantly.

3. Stamp Duties

Cover Buyer's Stamp Duty (BSD) and Additional Buyer's Stamp Duty (ABSD) using CPF savings (where applicable).

4. Legal and Processing Fees

Pay for conveyancing fees, and other legal expenses related to your property transaction.

5. Home Protection Scheme (HPS) Premiums

For HDB flat buyers, use OA savings to pay for mandatory mortgage insurance coverage.

How Much CPF Can You Actually Use to Buy Property in Singapore?

CPF Usage Limits Based on Property Type

The amount of CPF you can use depends on several critical factors:

For Full CPF Usage:

Your property's remaining lease must cover you until age 95. If the remaining lease plus your age (as the youngest buyer) equals or exceeds 95, you can use your full CPF OA balance for the purchase.

For Partial CPF Usage:

If the remaining lease doesn't last until you turn 95, your CPF usage is pro-rated. Use the CPF Housing Usage Calculatorto determine your eligible amount.

Key CPF Housing Restrictions to Know

$20,000 Minimum Balance Requirement: When taking an HDB loan, you must maintain at least $20,000 in your CPF OA after property withdrawals.

Basic Retirement Sum (BRS) Requirement: If you already own property financed with CPF, you must set aside the BRS ($105,600 in 2025) before using OA savings for another property.

CPF Usage Cap: You cannot use more than your available OA balance or exceed the lower of the purchase price or valuation price.

For more information about the usage of CPF for property purchase in Singapore, refer to my earlier blog https://propzenconsultant.com/blog/using-cpf-savings-for-property-purchase

Why CPF Allocation Matters When Buying Property in Singapore

1. Age Significantly Impacts Your Housing Budget

Younger buyers benefit from higher OA allocation rates, meaning more CPF accumulates for housing purposes each month. If you're 30 years old, over 62% of your monthly CPF builds your housing fund. By age 60, this drops to just 14.9%.

Financial Planning Insight: Starting your property search earlier in life maximizes your CPF accumulation potential for housing, giving you stronger purchasing power.

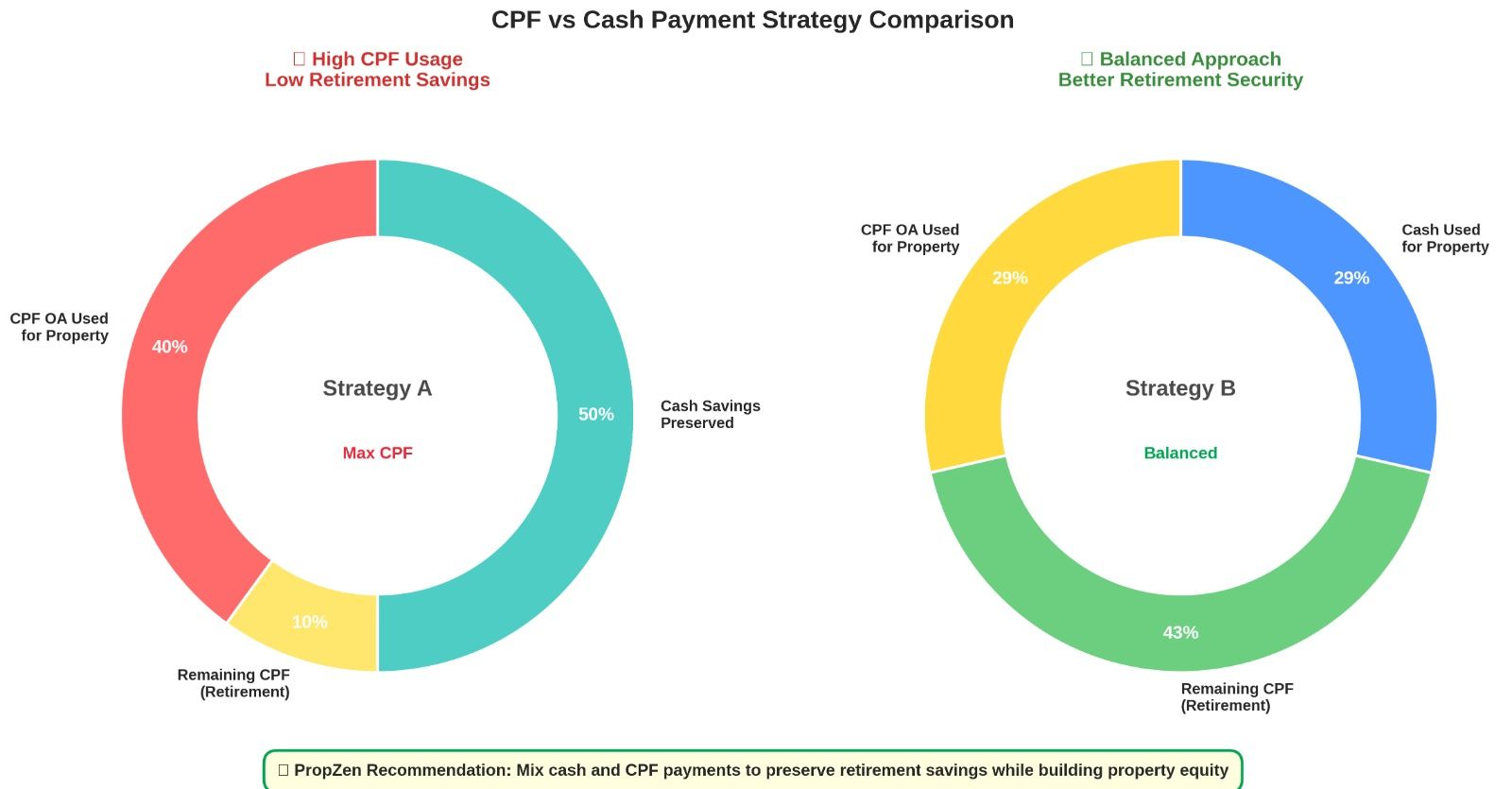

2. Retirement Savings vs. Housing Investment

Using CPF for property reduces your retirement nest egg. The government requires you to refund all CPF used (plus accrued interest at 2.5% annually) when you sell your property.

Strategic Consideration: Balance your housing payments between cash and CPF to optimize long-term returns.

3. Planning for Multiple Properties

Second-time buyers face additional CPF restrictions. You must set aside the Basic Retirement Sum before using OA savings for subsequent properties, limiting your CPF access.

Investment Strategy: Calculate your available CPF carefully when planning property upgrades or investment purchases to avoid unexpected cash flow constraints.

Smart CPF Strategies for Singapore Property Buyers

Optimize Your Down Payment Strategy

Mix Cash and CPF Wisely: While you can use CPF for most of the down payment (except the 5% minimum cash for bank loans), consider preserving some CPF for retirement growth at higher interest rates.

Leverage Housing Grants: First-time buyers can stack Enhanced CPF Housing Grant (EHG) up to $80,000 or Proximity Housing Grant (PHG) up to $30,000, effectively supplementing your OA balance.

More information about housing grants can be found on: https://propzenconsultant.com/blog/hdb-grants-for-first-timers-and-second-timers--your-ultimate-guide-to-housing-assistance-in-2024

Monitor Your CPF OA Balance Regularly

Track your CPF usage through the Home Ownership Dashboard to:

- Check available OA balance for property

- Monitor monthly deductions

- Plan for future property transactions

- Ensure you haven't exceeded usage limits

Consider Voluntary CPF Refunds

Making voluntary refunds to your CPF after property purchase offers dual benefits:

- Boost retirement savings with compound interest

- Increase cash proceeds when selling (less required refund)

The earlier you refund, the more interest compounds for retirement.

Common CPF Housing Questions Answered

Can I use CPF to buy a private condominium in Singapore?

Yes, you can use CPF Ordinary Account savings for private property under the CPF Housing Scheme, subject to eligibility requirements and lease restrictions.

What happens to my CPF when I sell my property?

You must refund all CPF used plus accrued interest (2.5% annually) back to your OA. This restores your retirement savings and allows you to use CPF for your next property.

Can SPR use CPF to buy property in Singapore?

Singapore Permanent Residents can use CPF for resale HDB flats and private properties, subject to specific eligibility criteria and restrictions.

Why does my CPF allocation change with age?

CPF automatically shifts priorities as you age, allocating more toward retirement (Special/Retirement Account) and healthcare (MediSave) while reducing housing allocation.

Why Understanding CPF Allocation Matters for Your Property Journey

Your CPF allocation rate directly impacts your home-buying timeline and budget capacity. At PropZenConsultant, we help Singapore buyers navigate the complex intersection of CPF planning and property investment to:

✓ Maximize your purchasing power at every life stage ✓ Balance housing goals with retirement security

✓ Plan property upgrades within CPF restrictions ✓ Optimize cash vs. CPF payment strategies ✓ Navigate eligibility requirements for grants and loans

Start Your Property Journey With Confidence

Whether you're a first-time HDB buyer or upgrading to a private condominium, understanding how your CPF works is the foundation of sound property planning in Singapore.

Ready to make your property dreams a reality? Contact PropZenConsultant today for personalized guidance on maximizing your CPF for housing while securing your financial future.

Quick CPF Housing Facts at a Glance

Q: How much CPF goes to housing if I'm 28 years old?

A: 62.17% of your monthly CPF contribution goes to your Ordinary Account, available for property purchase.

Q: Can I use 100% CPF for my down payment?

A: For bank loans, you must pay at least 5% in cash. The remaining down payment can come from CPF. For HDB loans, you can use 100% CPF for the down payment.

Q: What's the minimum CPF I need to buy a condo?

A: There's no fixed minimum, but you need sufficient OA balance to cover your intended usage. Many buyers supplement CPF with cash savings.

Q: Does using CPF for housing affect my retirement?

A: Yes. Every dollar used for housing is deducted from your retirement fund, plus you lose the compound interest it would have earned (2.5% annually for OA).

Q: When should I use cash instead of CPF for property?

A: Consider using more cash if you're older (preserving limited CPF for retirement), have high cash reserves, or want to maximize CPF interest earnings in higher-earning accounts.

PropZenConsultant: Singapore’s Trusted Real Estate Agency | Flat Fee Commission & 1% Packages

Maximize savings with PropZenConsultant’s flat fee commission solutions for streamlined property marketing. Need professional photography and virtual tours? Opt for our 1% commission package—a cost-effective, comprehensive service designed to elevate your listings.

As a leading Singapore real estate agency, PropZenConsultant specializes in high-impact marketing strategies for the digital era. Our expert team crafts stunning virtual tours and professional visuals to make your properties stand out, ensuring exceptional engagement and faster sales.

Why Choose PropZenConsultant?

Fix fee commission: Save more, sell smarter.

1% commission package: Includes professional photography + virtual tours.

Trusted expertise: 16 years of experience and being featured on 95.8 Fm/96.3Fm/CNA93.8Fm/AsiaOne

Transform your real estate business with captivating virtual tours and data-driven results. Contact PropZenConsultant today to unlock cutting-edge solutions for your property marketing needs!

#SingaporeRealEstate #FlatFeeCommission #VirtualTours #ProfessionalPhotography #PropZenConsultant