Singapore's New Seller's Stamp Duty: A Return to Stricter Property Cooling Measures Post

Singapore's New Seller's Stamp Duty: A Return to Stricter Property Cooling Measures

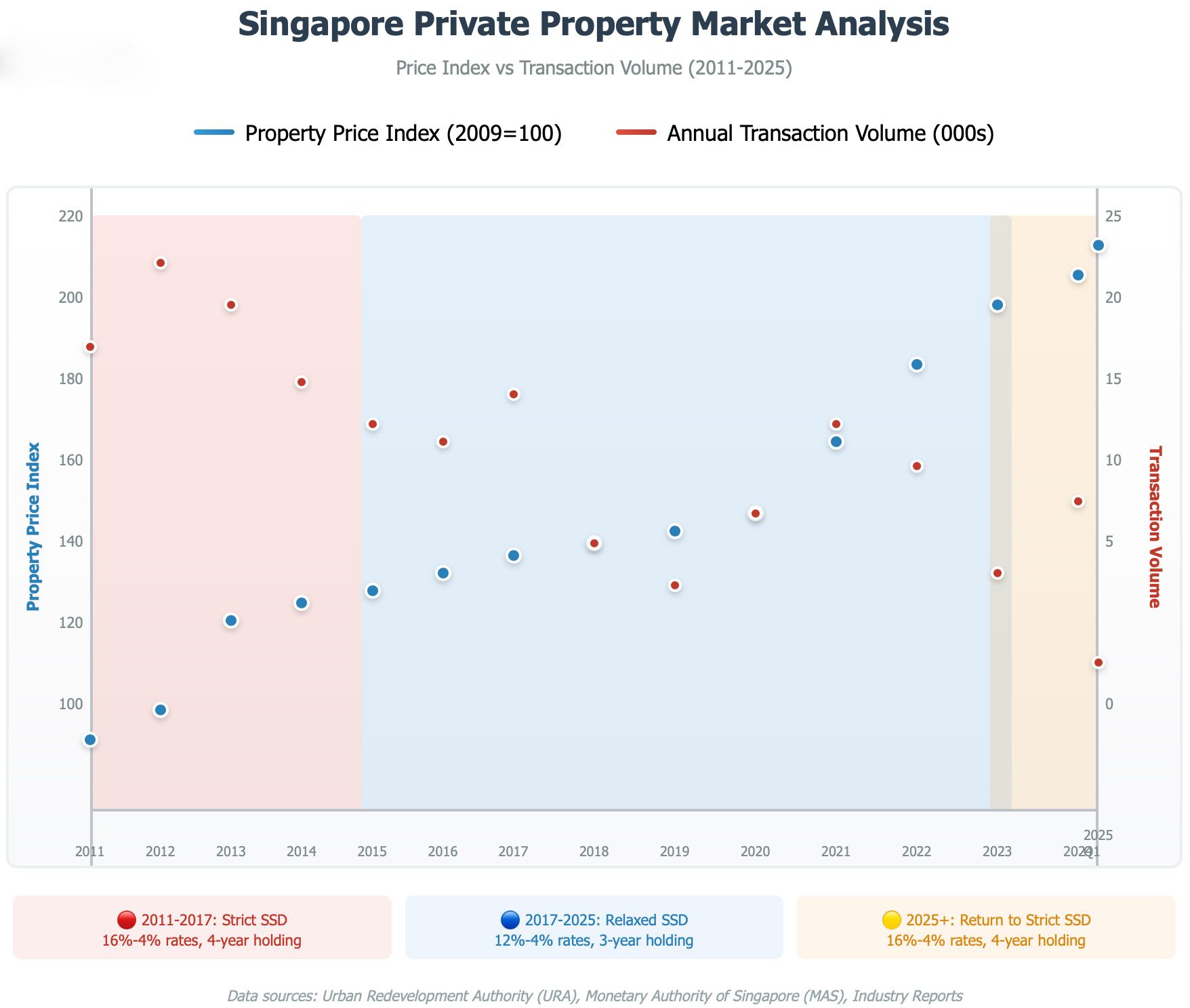

Singapore's property market is experiencing another significant policy shift as the government reintroduces stricter Seller's Stamp Duty (SSD) measures effective July 4, 2025. This move marks a return to the same rates and holding periods that were previously in effect from January 14 2011, to March 10 2017, signaling the government's renewed commitment to curbing speculative property trading.

What's New: The July 2025 SSD Changes

The Monetary Authority of Singapore (MAS) and the Inland Revenue Authority of Singapore (IRAS) announced comprehensive changes to the Seller's Stamp Duty framework on July 3, 2025, targeting private residential properties purchased on or after July 4 2025 12:00 AM.

Key Changes Include:

Extended Holding Period:

Increased from 3 years to 4 years

Properties must now be held for over 4 years to avoid SSD

Higher Tax Rates:

- Year 1: 16% (up from 12%)

- Year 2: 12% (up from 8%)

- Year 3: 8% (up from 4%)

- Year 4: 4% (new tier)

- After 4 years: No SSD payable

Historical Comparison: Three Distinct SSD Periods

Period 1: January 14, 2011 - March 10, 2017 (Original Strict Regime)

- Holding Period: 4 years

- Rates: 16%, 12%, 8%, 4%

- Market Context: Introduced during a property boom to cool speculation

Period 2: March 11, 2017 - July 3, 2025 (Relaxed Regime)

- Holding Period: 3 years

- Rates: 12%, 8%, 4%

- Market Context: Reduced rates to stimulate market activity

Period 3: July 4, 2025 - Present (Return to Strict Regime)

- Holding Period: 4 years

- Rates: 16%, 12%, 8%, 4%

- Market Context: Response to increased speculative activity and sub-sales

Market Impact Analysis: Then vs. Now

Sub-Sale Transaction Surge

According to Urban Redevelopment Authority data, sub-sale transactions have increased dramatically:

- 2015-2020 average: 88 transactions annually

- 2020-2025 average: 220 transactions annually

- 150% increase in speculative trading activity

SSD PERIODS:

🔴 2011-2017: Strict SSD (16%-4% rates, 4-year holding)

🔵 2017-2025: Relaxed SSD (12%-4% rates, 3-year holding)

🟡 2025+: Return to Strict SSD (16%-4% rates, 4-year holding

Property Price Performance During Previous SSD Period (2011-2017)

Despite the strict SSD regime from 2011-2017, Singapore's property market demonstrated remarkable resilience:

Price Index Growth (2011-2017):

- Private residential properties appreciated by approximately 21.7% between 2011-2013

- Overall market growth of 99.3% from 2011 to present

- The SSD did not significantly suppress long-term price appreciation

Current Market Conditions (2025)

Q1 2025 Performance:

- Private Property Price Index rose 0.81% quarter-on-quarter

3.33% year-on-year growth - Non-landed properties led growth with 0.95% quarterly increase

- Landed properties recovered with 0.38% quarterly growth

Transaction Volumes:

- 3,375 new private homes sold in Q1 2025

- 3,886 resale and sub-sale transactions

- Outside Central Region (OCR) dominated with 58% of total sales

Why the 2025 SSD Implementation May Be Less Impactful

Market Maturity Factor

The Singapore property market has evolved significantly since 2011:

- Buyer Sophistication: Today's buyers are more financially prudent and less speculative compared to 2011

- Market Stability: Established cooling measures have created a more stable foundation

- Economic Resilience: Stronger household balance sheets and diverse economic base

Supply Pipeline Considerations

Unlike 2011, the current market faces:

- 30,000+ units launching over the next two years

- Better supply-demand balance

- More measured release schedules from developers

Financial Environment Differences

- Lower mortgage rates in 2025 vs. 2011

- Improved banking regulations and stress testing

- Stronger regulatory framework overall

Regional Performance and Volume Trends

Price Index by Region (Q1 2025)

- Core Central Region (CCR): Premium segment at SGD 2,612 per sqft

- Rest of Central Region (RCR): Moderate growth trajectory

- Outside Central Region (OCR): Leading volume with 73% of new launches

Transaction Volume Distribution

New Launches (Q1 2025):

- OCR: 73% (2,284 units)

- RCR: 25%

- CCR: 2%

Rental Market Stability:

- Overall rental prices increased 2.5% year-on-year

- Rental volumes up 10.7% compared to June 2024

Expert Predictions and Market Outlook

Industry Forecasts for 2025

CBRE Projections:

- 7,000-8,000 new private home sales expected

- 3-4% price appreciation forecast

- Cautiously optimistic outlook

PropNex Estimates:

- 8,000-9,000 new home sales projected

- 14,000-15,000 resale units expected

- Market resilience despite policy changes

Long-term Impact Assessment

Positive Market Effects:

- Reduced speculative activity

- More stable pricing environment

- Protection against supply shocks

- Enhanced market confidence for genuine buyers

Potential Challenges:

- Reduced flexibility for urgent sellers

- Higher transaction costs for short-term holders

- Possible temporary volume reduction

Investment Strategy Implications

For Property Investors

- Extended Investment Horizon: Plan for minimum 4-year holding periods

- Quality Over Speculation: Focus on fundamental value rather than quick flips

- Location Selection: OCR properties may offer better volume opportunities

For Homeowners

- Upgrade Timing: Consider current property cycles before upgrading

- Financial Planning: Factor SSD costs into sale calculations

- Market Timing: Properties purchased before July 4, 2025, remain under old regime

Conclusion: A Measured Response to Market Dynamics

The return to stricter SSD measures represents a measured response to increasing speculative activity in Singapore's property market. While the rates mirror the 2011-2017 period, the current market's maturity, improved supply pipeline, and stronger regulatory framework suggest that the impact may be more muted than during the original implementation.

Key Takeaways:

- The new SSD regime prioritizes long-term homeownership over speculation

- Market fundamentals remain strong despite policy tightening

- Genuine buyers and long-term investors are likely to benefit from increased stability

- The policy reinforces Singapore's commitment to sustainable property market growth

Property stakeholders should view these changes as a continuation of Singapore's proactive approach to market management rather than a dramatic policy shift. The precedent set during 2011-2017 demonstrates that well-managed cooling measures can coexist with healthy market appreciation.

Sources:

Monetary Authority of Singapore (MAS) Media Release, July 3, 2025

Inland Revenue Authority of Singapore (IRAS) Official Guidelines

Urban Redevelopment Authority (URA) Property Market Statistics

Industry reports from CBRE, PropNex, and market analysts

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Consult with qualified property professionals before making investment decisions.

PropZenConsultant: Singapore’s Trusted Real Estate Agency | Flat Fee Commission & 1% Packages

Maximize savings with PropZenConsultant’s fixed fee commission solutions for streamlined property marketing. Need professional photography and virtual tours? Opt for our 1% commission package—a cost-effective, comprehensive service designed to elevate your listings.

As a leading Singapore real estate agency, PropZenConsultant specializes in high-impact marketing strategies for the digital era. Our expert team crafts stunning virtual tours and professional visuals to make your properties stand out, ensuring exceptional engagement and faster sales.

Why Choose PropZenConsultant?

Flat fee commission: Save more, sell smarter.

1% commission package: Includes professional photography + virtual tours.

Trusted expertise: 16 years of experience and being featured on 95.8 Fm/96.3Fm/CNA93.8Fm/AsiaOne

Transform your real estate business with captivating virtual tours and data-driven results. Contact PropZenConsultant today to unlock cutting-edge solutions for your property marketing needs!

#SingaporeRealEstate #FlatFeeCommission #VirtualTours #ProfessionalPhotography #PropZenConsultant