Complete Guide to Using CPF for Property Purchase in Singapore

Buying your first home in Singapore? Your Central Provident Fund (CPF) is one of your most powerful tools for homeownership. This guide explains everything you need to know about using CPF Ordinary Account (OA) savings for property purchases, housing grants available, and smart strategies to balance your home purchase with retirement planning.

Complete Guide Navigation 🏠

Getting Started

- Understanding CPF for property purchases

- What CPF can cover

- How much you can use

💰 Grants & Subsidies

- Enhanced CPF Housing Grant (up to $120,000)

- Resale flat grants

- Proximity Housing Grant

📊 Planning Tools

- CPF Home Purchase Planner

- Withdrawal limit calculators

- Retirement impact assessment

✅ Taking Action

- 7-step home buying process

- Required documents

- Application procedures

⚠️ Avoid These Mistakes

- Common CPF errors

- Financial pitfalls

- Expert warnings

❓ Your Questions Answered

- FAQs from first-time buyers

- Recent policy changes

- Where to get help

Reading Time:** 12 minutes

What is CPF and How Does It Help You Buy Property?

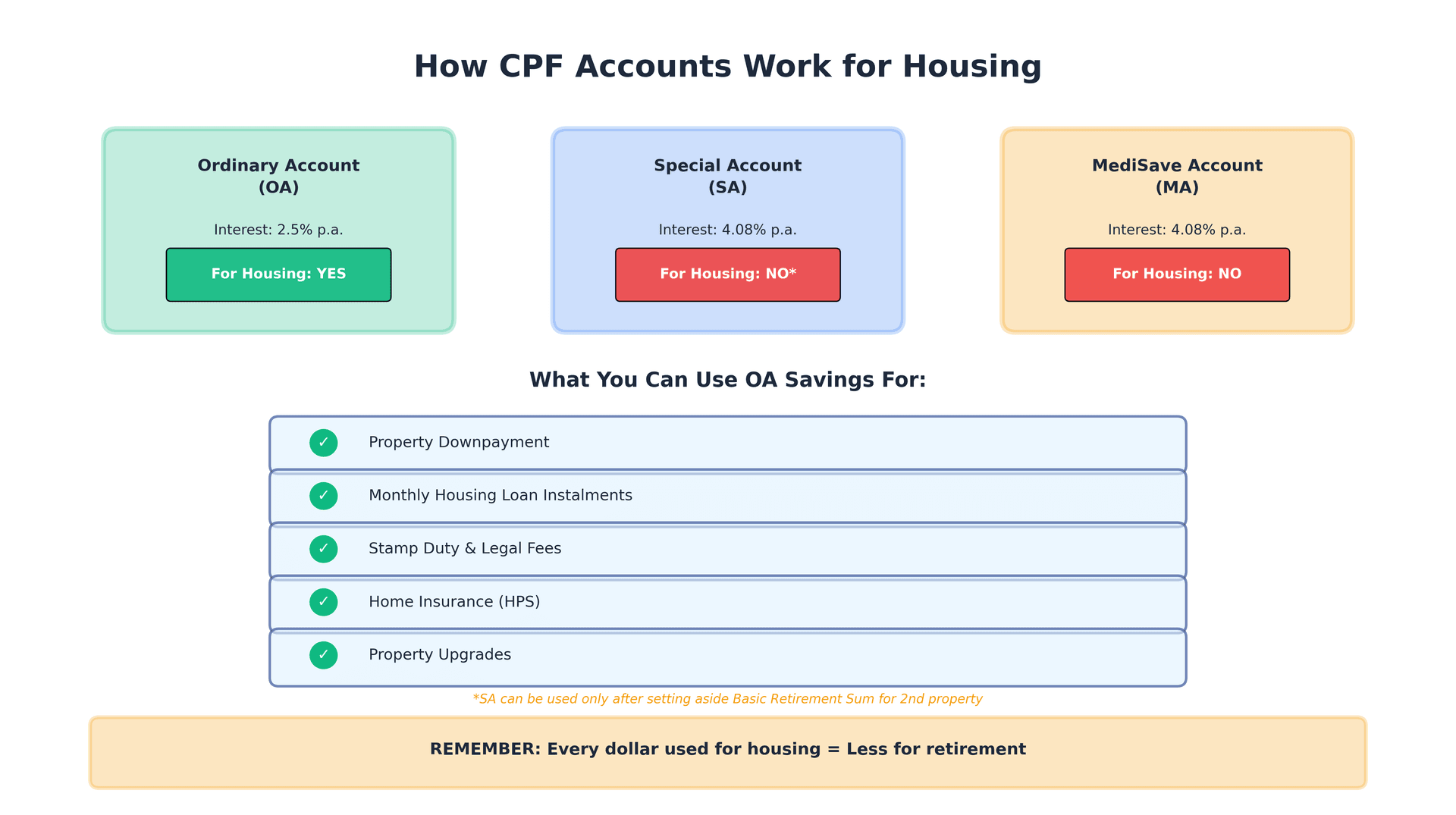

The Central Provident Fund is Singapore's comprehensive social security system that helps citizens and permanent residents save for retirement, healthcare, and housing. Your CPF consists of three main accounts, but for property purchases, the Ordinary Account (OA) is the key player.

Your OA savings earn attractive interest rates and can be used for various housing-related expenses, making homeownership more accessible for Singaporeans.

To find out how much you can utilise from your OA at different ages for your property, you can refer to our blog https://propzenconsultant.com/blog/cpf-housing-singapore-2025

What Can You Use Your CPF For When Buying Property?

Your CPF OA savings can cover multiple aspects of your home purchase:

For HDB Flats and Private Properties:

- Property downpayment

- Monthly housing loan instalments

- Stamp duty and legal fees

- Home insurance premiums (Home Protection Scheme)

- Property upgrades and renovations

This flexibility means you don't need to rely entirely on cash savings, especially when making that crucial first property purchase.

How Much CPF Can You Use for Property Purchase?

There are withdrawal limits on how much CPF you can use, and these depend on several factors including the property's remaining lease and your age.

Key Rules Effective from May 10, 2019:

First Property: You can use up to 100% of the Valuation Limit (lower of purchase price or property valuation) if the remaining lease can cover the youngest buyer until at least age 95.

Second or Subsequent Properties: You must first set aside the current Basic Retirement Sum in your OA and Special Account before using excess OA savings. Usage is also capped at 100% of the Valuation Limit.

Pro-rated CPF Usage: If the property's remaining lease cannot cover you to age 95, your CPF usage will be proportionally reduced.

Smart Tip: Keep a Safety Buffer

PropZenConsultants recommend retaining at least $20,000 in your OA even after your property purchase. This emergency fund can cover monthly instalments during unexpected situations like job loss, ensuring you don't lose your home during difficult times.

CPF Housing Grants: Free Money for Your Home Purchase

The Singapore government provides substantial housing grants to make homeownership more affordable. These grants are directly credited to your CPF OA and don't need to be repaid.

Enhanced CPF Housing Grant (EHG) - Up to $120,000

First-timer families can receive up to $120,000 when purchasing BTO flats or resale HDB units. The grant amount depends on your household income:

For Families (2 or more applicants):

- Up to $80,000 for 4-room flats or smaller

- Up to $50,000 for 5-room or larger flats

- Additional $10,000 for SC-PR couples upon birth of first child or when PR becomes citizen

For Singles:

- Up to $60,000 for eligible single first-timers

- Can combine grants when two singles purchase together (up to $120,000 total)

CPF Housing Grant for Resale Flats - Up to $80,000

Families purchasing resale flats can qualify for up to $80,000 in housing subsidies under the CPF Housing Grant Scheme, provided they meet income and eligibility criteria.

Proximity Housing Grant (PHG) - Up to $30,000

Encouraging multi-generational living, the PHG provides up to $30,000 when you purchase a resale flat to live with or near your parents or married children (within 4km).

For a detail breakdown of CPF housing grants, you can refer to our blog https://propzenconsultant.com/blog/hdb-grants-for-first-timers-and-second-timers--your-ultimate-guide-to-housing-assistance-in-2024

CPF Home Purchase Planner: Your Essential Budgeting Tool

Before committing to any property, use the CPF Home Purchase Planner - a free comprehensive calculator that goes beyond simple loan calculations.

What the Home Purchase Planner Does:

- Personalized Budget Calculation: Factors in your current savings (cash and CPF), income, expenses, and for existing homeowners, sales proceeds from your current property.

- Detailed Financial Breakdown: Shows your estimated housing loan amount, monthly instalments, downpayment requirements, stamp duty, and legal fees.

- Retirement Impact Assessment: Most importantly, it illustrates how your home purchase will affect your CPF LIFE retirement payouts, helping you make informed decisions that balance present needs with future security.

- OA Balance Preview: See your projected OA balance after making all upfront payments, helping you maintain adequate reserves.

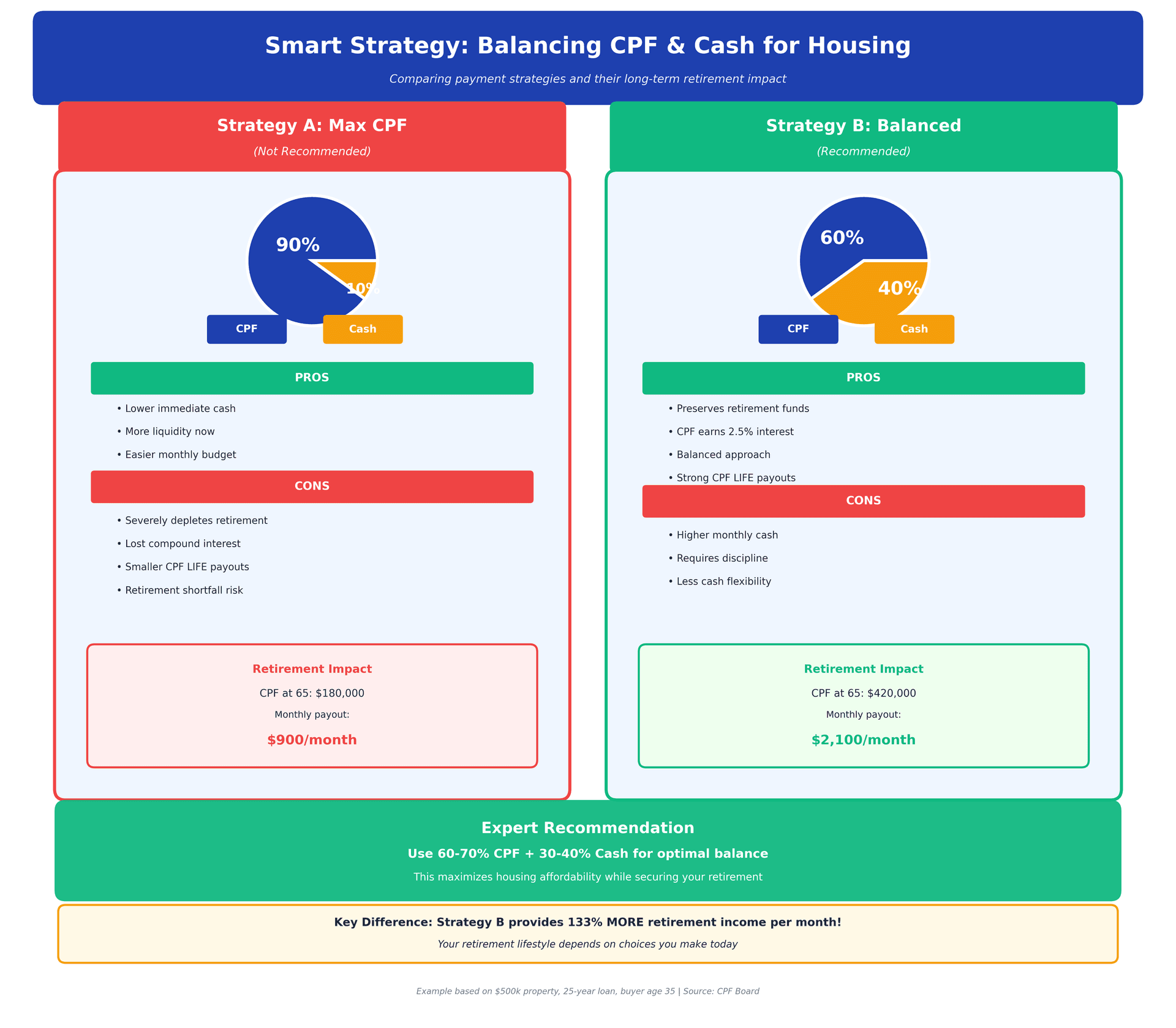

Balancing Home Purchase with Retirement: The Critical Trade-off

Here's the reality many first-time buyers overlook: every dollar you withdraw from your CPF OA for property reduces your retirement savings. When you use $300,000 from your OA for a home, you're not just losing $300,000 - you're also losing the attractive CPF interest that money would have earned over 20-30 years.

Smart Strategies to Protect Your Retirement:

Use a Cash-CPF Mix: Instead of maximizing CPF usage, consider paying your monthly instalments partially with cash. This preserves your OA savings which continue earning guaranteed interest rates.

The 80-20 Rule: Some financial advisors recommend using no more than 80% CPF and paying at least 20% with cash for your housing expenses.

Voluntary Housing Refunds: When you can afford it, make voluntary refunds to your CPF to restore the principal and accrued interest. This not only boosts retirement savings but may also increase cash proceeds when you sell your property.

Keep Working OA Balance: Maintain at least $20,000-40,000 in your OA as an emergency buffer and to continue earning attractive interest.

Understanding CPF Housing Withdrawal Limits

The CPF Board has implemented withdrawal limits to ensure members don't completely deplete their retirement savings for housing. Use the CPF Housing Usage Calculator to estimate when you'll reach these limits based on:

- Your age and co-owners' ages

- Property purchase price and valuation

- Property's remaining lease duration

- Whether it's your first or subsequent property

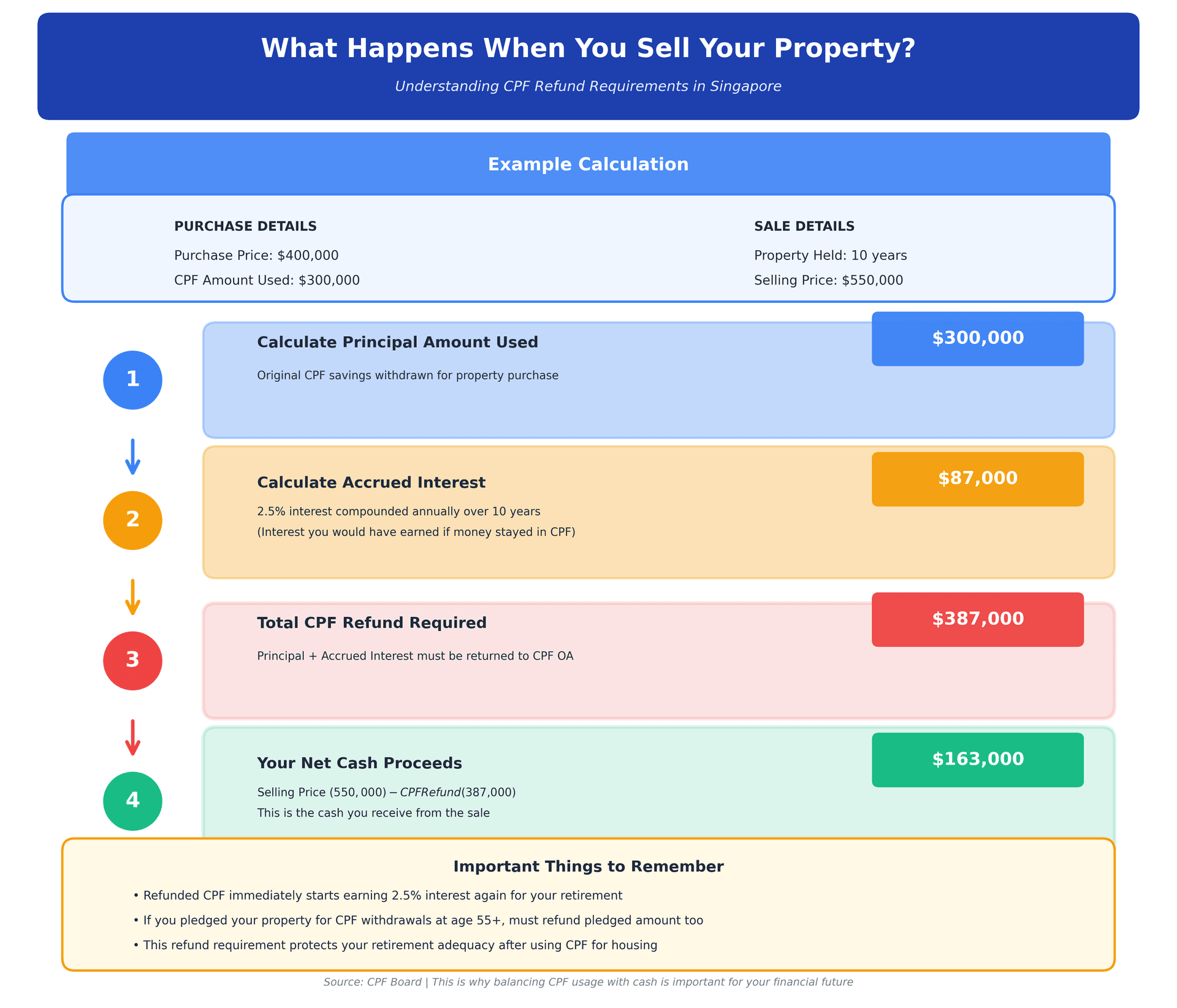

What Happens When You Sell Your Property?

When you sell a property purchased with CPF, you must refund to your CPF account:

Principal Amount Used: All CPF savings withdrawn for the property

Accrued Interest: The interest you would have earned if those funds remained in your CPF account

Pledged Amount: If you're 55+ and pledged your property to withdraw CPF Retirement Account savings

For more information about the usage of CPF on or after age of 55 you can check on our 2 blogs

https://propzenconsultant.com/blog/cpf-savings-for-mortgages-and-housing-purchases-after-55

This refund requirement ensures your retirement adequacy isn't permanently compromised by using CPF for housing. The refunded amount immediately starts earning CPF interest again.

Home Protection Scheme (HPS): Safeguarding Your Home

If you're using CPF to pay monthly housing instalments for your HDB flat, you must be insured under the Home Protection Scheme. HPS is mortgage-reducing insurance that protects you and your family from losing your home in case of:

- Death

- Terminal illness

- Total permanent disability

Premiums can be paid using your MediSave account, and coverage automatically adjusts as your outstanding loan decreases. Use the HPS Premium Calculator to estimate your premiums.

Property Types Eligible for CPF Usage

You can use CPF OA savings for:

Public Housing:

- New BTO HDB flats

- Resale HDB flats

- Executive Condominiums (ECs) from developers

- DBSS (Design, Build and Sell Scheme) flats

Private Property:

- Condominiums and apartments

- Landed properties (terrace, semi-detached, detached houses)

- Privatised HUDC flats

Important Exclusion: You cannot use CPF for properties with a remaining lease of 20 years or less.

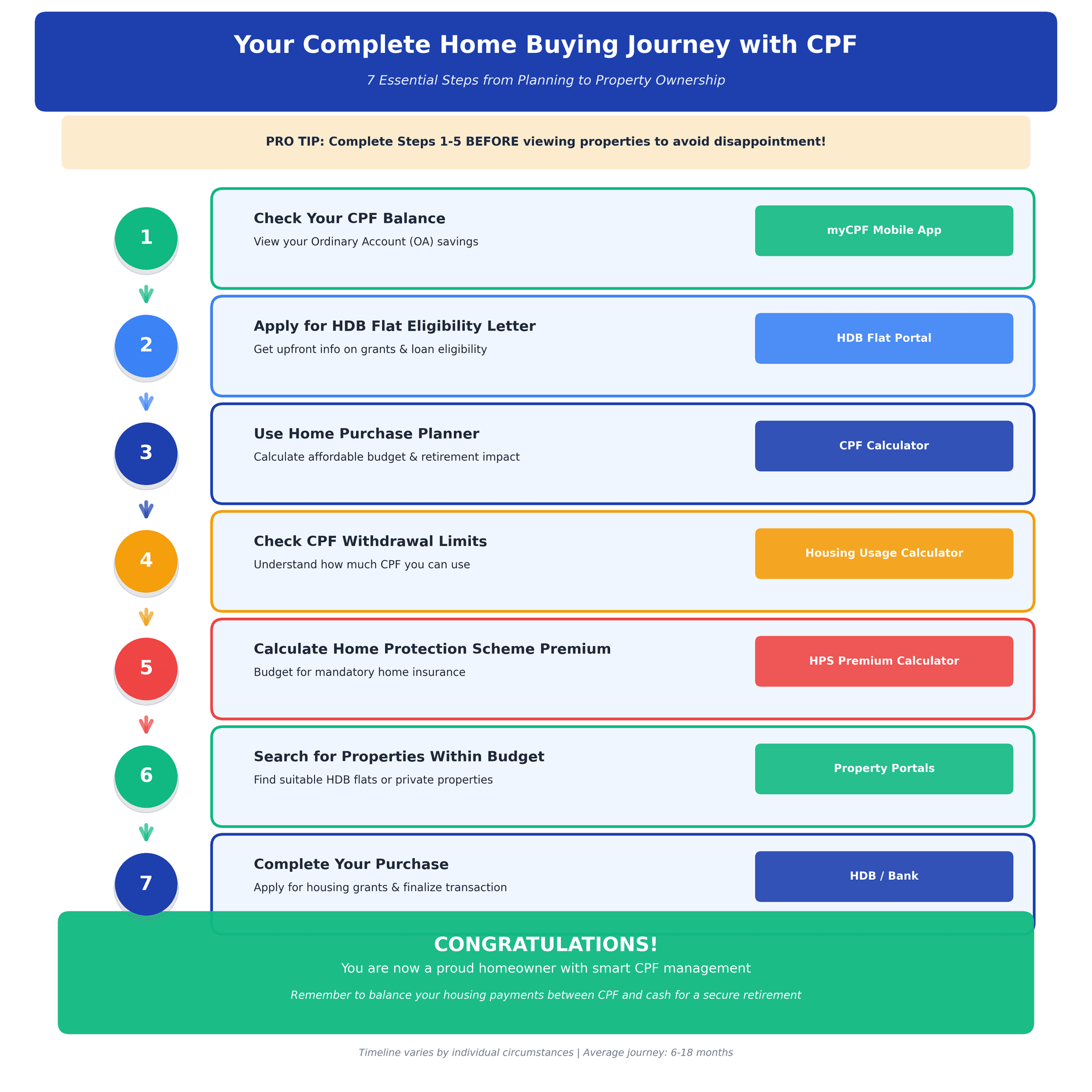

Step-by-Step: Using CPF for Your First Home

Step 1: Check your CPF OA balance via the CPF mobile app or myCPF portal

Step 2: Apply for HDB Flat Eligibility (HFE) letter to understand your housing grant eligibility and loan options

Step 3: Use the CPF Home Purchase Planner to estimate your affordable budget considering retirement impact

Step 4: Use the CPF Housing Usage Calculator to understand withdrawal limits

Step 5: Calculate your HPS premiums if buying an HDB flat

Step 6: Start your property search within your calculated budget

Step 7: Apply for housing grants when booking your flat or during resale completion

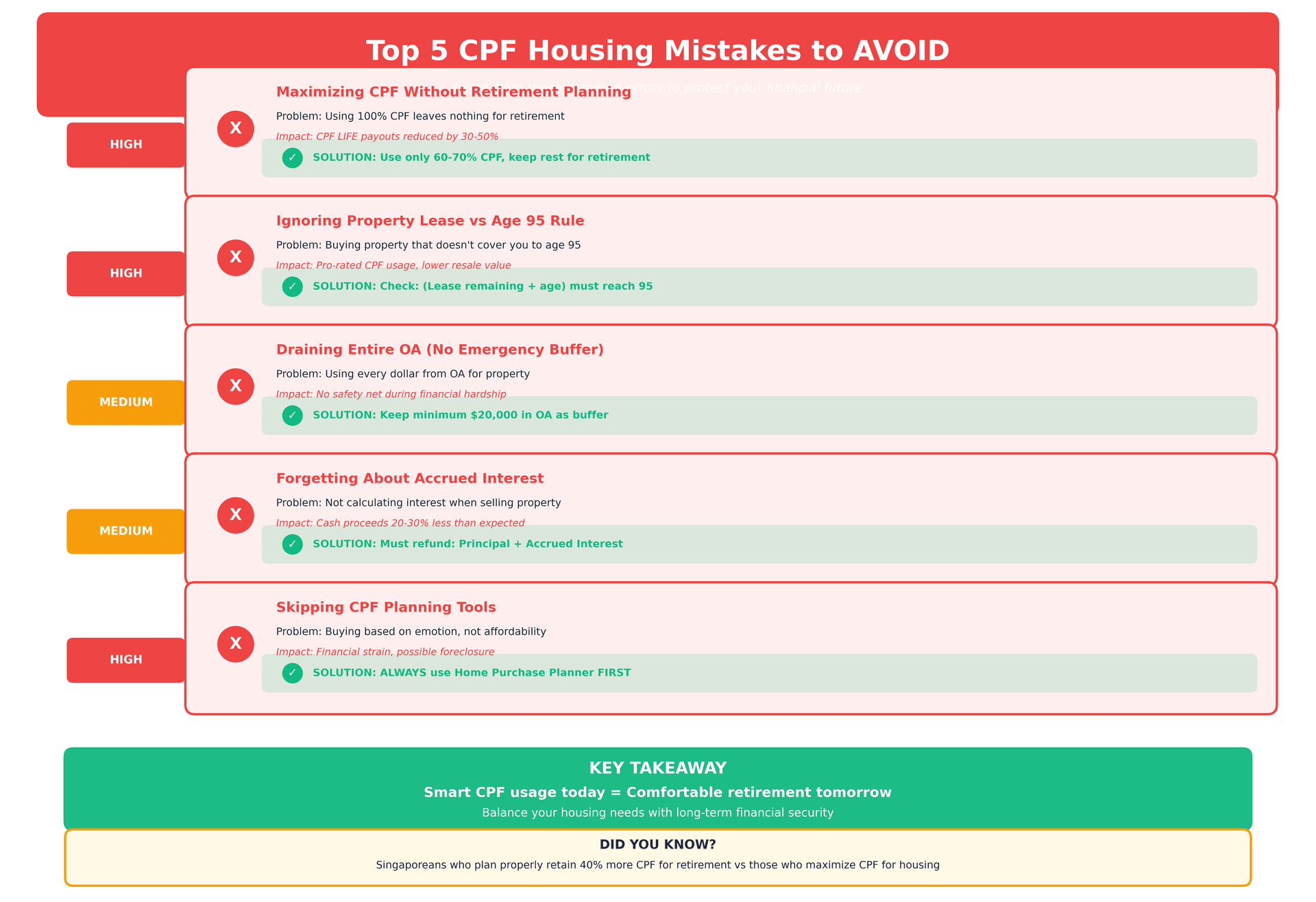

Common Mistakes to Avoid

Maximizing CPF Usage Without Considering Retirement: The biggest mistake is using maximum CPF for your home, leaving insufficient funds for retirement.

Ignoring Remaining Lease Impact: Properties with shorter remaining leases significantly limit your CPF usage and may affect future resale value.

Not Maintaining Emergency Buffer: Using your entire OA balance leaves you vulnerable during financial emergencies.

Forgetting About Accrued Interest: Many buyers don't realize they must refund both principal and accrued interest when selling, which can significantly reduce expected proceeds.

Skipping the Home Purchase Planner: Not using official CPF calculators can lead to overestimating what you can afford.

Recent Changes and Updates (2024-2025)

Enhanced Housing Grants: From August 20, 2024, first-timer families can now receive up to $120,000 in EHG grants (increased from previous limits).

Stricter Lease Requirements: Properties must increasingly meet the "lease to age 95" requirement for full CPF usage, making property selection more critical.

Digital Tools Enhancement: CPF Board has improved the Home Purchase Planner with more accurate retirement impact projections.

Frequently Asked Questions

Q: Can PRs use CPF for property purchase? Yes, Singapore Permanent Residents can use CPF OA savings for eligible properties, though some housing grant amounts may differ from citizens.

Q: Can I use my parent's CPF for my property? No, only buyers listed on the property title can use their CPF for that property.

Q: What if I have insufficient CPF for downpayment? You'll need to top up with cash. The minimum downpayment is typically 25%CPF/Cash) for HDB loans, or higher for bank loans(5% cash + 20% CPF/cash).

Q: Can I use CPF for overseas property? No, CPF can only be used for properties in Singapore.

Q: Will using CPF affect my CPF LIFE payouts? Yes, using CPF for housing reduces your retirement savings and therefore your future CPF LIFE payouts. Use the Home Purchase Planner to see the exact impact.

Final Thoughts: Smart CPF Usage for Homeownership

Your CPF is simultaneously your ticket to homeownership and your retirement security. The key is finding the right balance. While it's tempting to maximize CPF usage to reduce immediate cash outlays, remember that every dollar used now is a dollar less (plus interest) for your golden years.

Use the CPF Board's planning tools, particularly the Home Purchase Planner and Housing Usage Calculator, to make informed decisions. Consider your long-term financial goals, not just immediate affordability. With proper planning, you can secure a comfortable home today while ensuring a secure retirement tomorrow.

Ready to start your home buying journey? Visit the CPF Board website to access all the calculators and tools mentioned in this guide, or speak with HDB directly about your eligibility and options.

Need Expert Help with Your CPF Housing Journey?

Navigating CPF rules, housing grants, and property purchases can be overwhelming. That's where PropZen Consultant comes in - we guide first-time buyers through every step with proven expertise.

Why Choose PropZen Consultant?

Media Recognition:

- Featured on **CNA 938 Open House** with Susan Ng

- Love 97.2FM property expert

- 96.3好FM (Hao FM) real estate consultant

- AsiaOne interview

Professional Credentials:

- CEA No R017994B

- 16 years in business (Est. 2009)

- Professional Indemnity Insurance

Proven Track Record:

- 290+ successful transactions

- Average 4.9/5.0 Google rating

- Multiple record-breaking sales

- 85% repeat/referral clients

- Properties sold on first viewing

Technology Advantage:

- FREE 360° Klapty virtual tours

- Data analytics for optimal pricing

- Multi-platform digital marketing

- Weekly performance reports

[Contact PropZen Consultant Today →]

We specialize in helping Singaporeans maximize their CPF benefits while finding the perfect home at 1% commission - saving you thousands in agency fees.